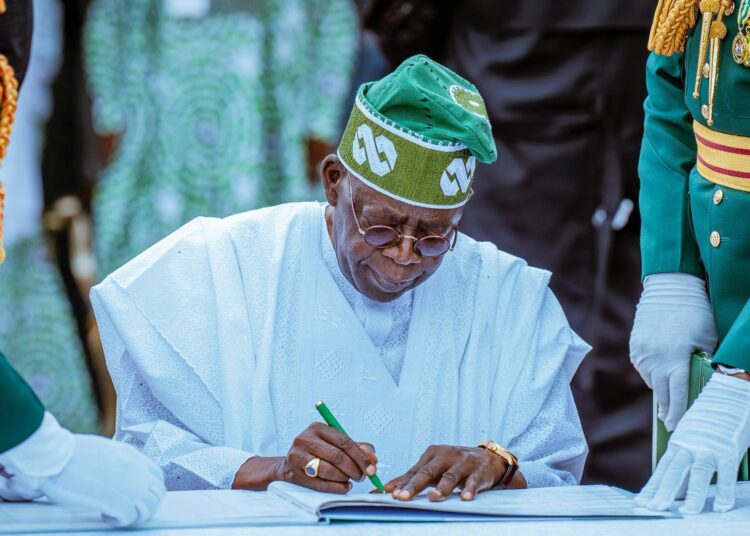

In his independence anniversary broadcast on October 1st, President Bola Tinubu enumerated his administration’s efforts to drive foreign direct investments into the country. He noted that within the first 16 months of his administration, the Government had attracted over $30 billion in FDI.

A section of the social media and television punditry that delights in criticising any announcement from the Government has gone into overdrive since the broadcast. Led by a desire to put a dagger at any positive news, they have been trying to outdo themselves, all to prove that the President made false claims. Fact-checkers are racing to determine who can fact-check the most. I told a few friends who have harangued me that there is nothing holy about any fact-checking, especially if the fact-checkers themselves do not know better. It is all a matter of perspectives and what is being checked.

A distinction should be made between attracting and securing investments. Investments need to be attracted first. Many other processes are involved in the intervening period before they are fully crystalised. Many critics are only focused on capital importation. That is a limited view of the investment process.

It is important to emphasise that attracting local or foreign investments does not mean immediate cash inflow into the economy. Investments could come from new foreign or local investors seeking to establish new ventures in the country or existing investors who want to expand their investments and footprints.

When President Tinubu attended the G20 Summit in India in August last year, he secured the commitments of Indian businessmen who pledged to make a combined $14 billion additional investment in Nigeria. Some of the Indian businessmen have existing businesses in Nigeria. The chairmen of Indorama and Bharti Airtel were in the room with President Tinubu when these announcements were made. The President didn’t impose these commitments on them. They saw the need themselves because of their confidence in the new economic direction being championed by the current administration.

At the meeting in New Delhi, Airtel Chairman Mr. Sunil Bharti Mittal said his company planned a $800 m new network expansion in Nigeria. In March this year, Airtel started construction of its $500m data centre at the Eko Atlantic City in Lagos.

President Tinubu was right in his broadcast speech when he said his administration had attracted more than $30 billion into the country to date. Some of these investments are in-country in the form of machinery and raw materials, some in cash, and some at various stages of final decisions.

A few days ago, the Special Adviser to the President on Energy, Olu Verheijen, hinted at new investments in the oil sector at a global forum in the USA. We already see statements from key Oil and Gas players to back her up.

ExxonMobil, during a meeting with Vice President Kashim Shettima in New York last week, revealed its plan to invest $10 billion in Nigeria’s deep water offshore to increase the nation’s crude oil output. Similarly, Total Energies announced a final decision on a $550 m investment in non-associated gas exploration and production. All these were based on President Tinubu’s Executive Orders for the Oil and Gas Sector.

Based on pronouncements by various companies and investors since the Tinubu Administration took office, the following represents a summary of the new round of investments that are committed to Nigeria:

1. ExxonMobil – $10 billion: ExxonMobil commits to invest the announced sum in expanding Nigeria’s deepwater oil production.

2. India – $14 billion: During President Tinubu’s visit to India, a range of investments were secured, including:

• Indorama – $8 billion for expanding its petrochemical and fertiliser plant in Nigeria.

• Bharti Airtel – $800 million for network expansion.

• Jindal Steel – $3 billion for steel production.

3. Coca-Cola—$1 billion: Coca-Cola’s global leadership recently visited President Tinubu and re-committed to the $1 billion they announced in 2021 to expand its distribution network and product range. Coca-Cola paused the investment in 2021 because the government is currently addressing some of the fiscal policy issues that affected the investment.

4. APPL – €9.2 billion: Alternative Petroleum & Power Ltd (APPL) is developing the Hydrogen Polis project to produce green hydrogen derivatives like green methanol and ammonia in Akwa Ibom State. The project includes 1,650 MW of renewable energy and will create 25,000 direct and indirect jobs.

5. Maersk—$600 million: Maersk is investing in Nigeria’s port infrastructure to increase cargo capacity and improve logistics.

6. Arise – $3.5 billion: Arise Integrated Industrial Platform is focusing on revitalizing Nigeria’s cotton and textile industries. Afrexim Bank supports this investment.

7. Afrexim – $5 billion: Afreximbank’s support includes a $5 billion country risk guarantee and funding mechanisms to support various projects, particularly in the manufacturing and energy sectors.

8. Shell – More than $3 billion: Shell’s investment is mainly directed at expanding LNG production, renewable energy projects, and infrastructure development within Nigeria’s energy sector.

9. Total Energies / NNPC Project Ubeta: $550m

Taken together, these are positive signs of the impact that the Administration’s policies are having on the investment landscape in Nigeria. They speak to faith in the Government’s policies, the Nigerian economy, and the Nigerian people. That the President highlighted this success story should be celebrated and certainly not be a cause for needless criticism.

The issues here remain that these commitments are real, and the President is working hard to create an economic and political environment that will make Nigeria a destination of choice for local and foreign investments. It is in our collective interest that these commitments fully mature. Our economy and people also benefit when businesses come here and do well.

-Ajayi is Senior Special Assistant to the President on Media and Publicity