14 gaming centre across Ibadan metropolis were on Thursday shut by the Oyo state government for various offences that bothers on tax defaults.

Acting through the Board of Internal Revenue (OYBIR), the agency saddled with generating government revenue, the enforcement team has be on an aggressive enforcement drive to ensure that the gaming centres conducted their business activities in line with the rules guiding the operations.

Areas covered in the enforcement operations include Sango, Mokola, Iwo road, Awolowo way, New Bodija, Beere, Molete and Challenge axis.

Some of the centres found culpable include, collabobet, surebet247, 1960bet, Jackpot pools and dollars pools.

Others are Zeus bet, saint victory, ocean pools, betnaija, golden chance, and winners bet, Fortune bet, Yangabet and Westcobet among others.

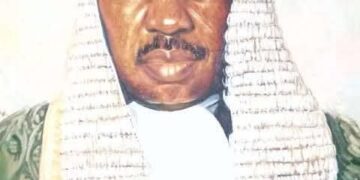

The chairman of the board, Mr. Bicci Alli, said the concern of his board in engaging in the enforcement drive is to ensure that organisations and business interest operating within the state comply strictly with the tax laws governing their operations.

The team of officials, made up of representatives of Oyo State Gaming Board and officials of the OYBIR who worked in various teams to face different parts of the state commenced the exercise from Awolowo way where some of the gaming centre were just opening for operations.

Mr Alli, reiterated that the affected companies, had earlier been officially communicated of their outstanding debt to the government and another reminded of their inability to fulfil their payment within the regulated time through a letter from the office of the Director, Trade, Ministry of Trade, K.W. Mustapha, pointing out that only those who failed to comply as at the due date were sealed up.

The enforcement effort carried out by the Board, it was gathered is in pursuant to the provision of section 8(1-2) Oyo state professional/business premises law 1996 (as amended) for varying years being owed.

But, some of the affected centres upon the activity swoop on the Revenue office of the board at the state secretariat to regularise their papers and make prompt payment to save their business.

Speaking with journalists at the end of the day’s exercise, the Board Chairman, Mr Alli said it is high time people of the state develop the culture of compliance of paying taxes, both to the state and federal authorities. He pointed out that the corporate entities affected by the exercise have been duly informed before the exercise was carried on Wednesday morning.

Alli said, “Basically, what we are doing is not different from what we are supposed to do. That is, just that we make sure we are ensuring that people do what they are supposed to do and that what is due to Oyo state is accrue to it.

Assuring that the Board will not act above the law, Alli noted that the agency had sensitised the affected entities a lot before the enforcement exercise which continue today, noting that“we have done a lot in writing, sensitising them, talking to them and exchanged a lot of correspondences before today.

“However, where they fail to do the right thing, we enforce. We are very serious about compliance. People should be ready to pay. It does not really matter how much they pay, not about the money but once they have the assessment. Our people should learn to do the right thing. They should develop the culture. Though we need to generate more revenue, it is not the amount per say but the culture of compliance that we want our people to cultivate”, he added.

On the corporate establishments that were sealed on Wednesday, Alli maintained that the board “followed due process. Assessment notices were served on the corporate entities to pay. A bulk of the liabilities we are recovering now relates to past years not necessarily 2018. We have evidence to show that notices were sent to the corporate entities while reminders of seven days to pay followed accordingly, but those sealed never took government serious.”